Hard skills include expertise in data analysis, knowledge of insurance policies, and skill in claims processing that are essential for managing patient coverage effectively.

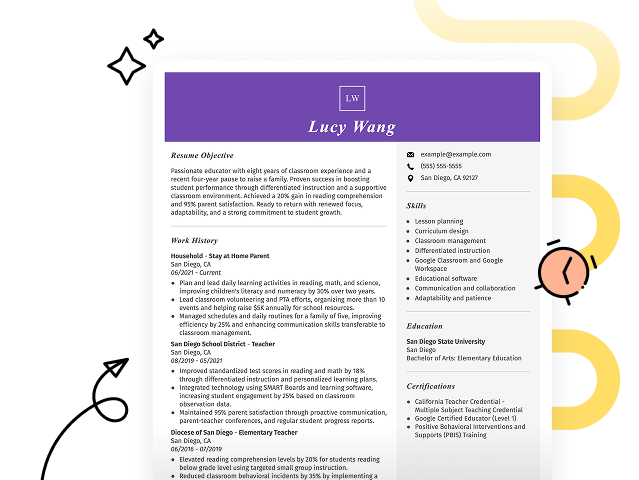

Popular Insurance Resume Examples

Discover our top insurance resume examples that demonstrate key skills such as risk assessment, policy analysis, and customer service excellence. These samples will help you effectively present your qualifications to potential employers.

Ready to build your winning resume? Our Resume Builder offers user-friendly templates specifically designed for professionals in the insurance industry, making it simple to create a standout application.

Recommended

Insurance agent resume

The resume employs clear formatting and professional resume fonts that improve readability, allowing key qualifications to shine. These design choices effectively showcase the job seeker's achievements and attention to detail, creating a strong impression on potential employers in the insurance field.

Insurance underwriter resume

This resume effectively balances important skills like risk assessment and policy analysis with relevant work experience. By showcasing these abilities alongside practical job roles, employers can clearly see how the job seeker applies their expertise to meet industry demands and drive business success.

Claims adjuster resume

This resume employs clear bullet points to distill extensive experience into digestible highlights, allowing hiring managers to quickly identify key contributions. Thoughtful spacing and section headings improve clarity, ensuring that significant accomplishments and qualifications stand out prominently on the page.

Resume Template—Easy to Copy & Paste

Hiro Tanaka

Cedar Valley, MN 55127

(555)555-5555

Hiro.Tanaka@example.com

Professional Summary

Dynamic insurance professional adept in risk assessment and claims processing. Proven track record in enhancing efficiency and policy sales with advanced skills in customer relationship management.

Work History

Insurance Specialist

SecureClaims Group - Cedar Valley, MN

June 2024 - October 2025

- Increased policy sales by 30% within one year

- Implemented new claims process reducing errors by 15%

- Trained team in compliance, improving audit scores by 20%

Risk Management Consultant

RiskShield Associates - Cedar Valley, MN

January 2022 - May 2024

- Conducted analysis reducing client risk by 25%

- Developed strategies saving 0k annually

- Enhanced safety protocols, decreasing incidents by 40%

Underwriting Assistant

SafeGuard Insurance - Minneapolis, MN

January 2020 - December 2021

- Processed 200+ applications monthly, surpassing targets

- Improved accuracy rate by 10% through QA methods

- Streamlined workflow cutting processing time by 15%

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Skills

- Risk Management

- Policy Analysis

- Claims Processing

- Customer Relationship

- Data Analysis

- Regulatory Compliance

- Strategic Planning

- Financial Assessment

Certifications

- Certified Insurance Counselor - National Alliance for Insurance Education

- Associate in Risk Management - The Institutes

Education

Master of Business Administration Finance

Northwestern University Evanston, Illinois

June 2019

Bachelor of Science Economics

University of Illinois Champaign, Illinois

June 2017

How to Write an Insurance Resume Summary

Your resume summary is the initial section that employers will read, making it important to craft a compelling introduction. In this brief overview, you should highlight your unique qualifications and experiences in the insurance field that make you an ideal job seeker.

As an insurance professional, focus on showcasing your analytical skills, customer service expertise, and any relevant certifications or achievements. This will help potential employers quickly grasp your strengths and suitability for their organization.

To illustrate what makes a successful insurance resume summary, we’ll provide examples that demonstrate effective strategies and common pitfalls:

I am an experienced insurance professional with a strong background in policy management and client relations. I hope to find a position that allows me to use my skills and contribute positively to the company. A role with good benefits and opportunities for advancement is what I desire. I believe I can add value if given the chance.

- Contains broad statements about experience without specific achievements or roles mentioned

- Relies on personal language, making it feel less professional and more casual

- Emphasizes what the applicant seeks rather than highlighting their unique contributions or strengths

Detail-oriented insurance professional with over 7 years of experience in claims processing and risk assessment. Streamlined claims review processes, leading to a 20% reduction in turnaround time and increased customer satisfaction ratings by 30%. Proficient in policy analysis, regulatory compliance, and using advanced software for data management.

- Begins with an exact experience level and highlights specific areas of expertise

- Incorporates quantifiable achievements that show direct impact on operational efficiency and customer satisfaction

- Mentions relevant technical skills that align with the demands of the insurance industry

Pro Tip

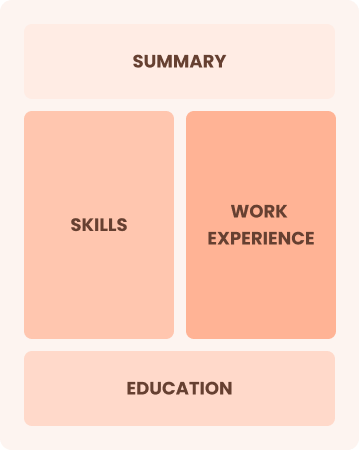

Showcasing Your Work Experience

The work experience section is important for your resume in the insurance field, as it contains the bulk of your content. Good resume templates always prioritize this section to help you effectively present your professional background.

This area should be structured in reverse-chronological order, highlighting your previous positions. Use bullet points to showcase key achievements and responsibilities that demonstrate your expertise in the insurance industry.

To guide you further, we'll share a couple of examples that illustrate what an effective work history entry looks like for insurance professionals. These examples will clarify what resonates with hiring managers and what pitfalls to avoid:

Insurance Agent

Kramer Insurance Group – Los Angeles, CA

- Helped clients with policies

- Answered questions about coverage

- Processed claims and paperwork

- Worked with team members to meet client needs

- Lacks specifics about the types of policies handled

- Bullet points do not highlight any notable achievements or metrics

- Describes basic responsibilities rather than powerful contributions

Claims Adjuster

State Farm Insurance – Atlanta, GA

March 2020 - Current

- Evaluate and process claims for auto insurance, ensuring compliance with state regulations and company policies

- Achieved a 30% reduction in claim resolution time through streamlined processes and effective communication with clients

- Conduct thorough investigations to assess damages and determine liability, resulting in a 95% accuracy rate in claims adjudication

- Uses strong action verbs to clearly convey the job seeker’s responsibilities and achievements

- Incorporates specific metrics that highlight the impact of the applicant’s work on efficiency and accuracy

- Demonstrates relevant skills essential for success in the insurance industry by detailing key accomplishments

While your resume summary and work experience are important, don’t overlook the importance of other sections that can improve your application. Each part plays a role in showcasing your qualifications. For detailed guidance on crafting an effective resume, refer to our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important for any insurance resume as it allows job seekers to quickly showcase their qualifications to potential employers. This section helps highlight your expertise and sets you apart in a competitive job market.

Employers want candidates who bring both technical know-how and strong people skills to the table. As you write your resume, make sure to highlight a balanced mix of hard and soft skills that reflect your full professional strengths.

Soft skills encompass strong communication, problem-solving abilities, and attention to detail that facilitate clear interactions with clients and ensure accurate service delivery.

Selecting the right resume skills is important for aligning with employer expectations and passing automated screening systems. Many organizations use software to sift through applications, filtering out job seekers who lack essential skills relevant to the position.

To effectively tailor your resume, carefully examine job postings for insights into which skills are in demand. Highlighting these key abilities will not only attract the attention of recruiters but also improve your chances of success with ATS evaluations.

Pro Tip

10 skills that appear on successful insurance resumes

Highlighting in-demand skills can significantly improve your resume and attract recruiters' attention for insurance roles. You can find examples of these skills showcased in our resume examples, helping you apply with the assurance that a well-crafted resume provides.

By the way, consider including any relevant skills from this list to align with your experience and job requirements:

Analytical thinking

Attention to detail

Customer service orientation

Problem-solving abilities

Regulatory knowledge

Risk assessment

Negotiation skills

Communication skills

Time management

Team collaboration

Based on analysis of 5,000+ insurance professional resumes from 2023-2024

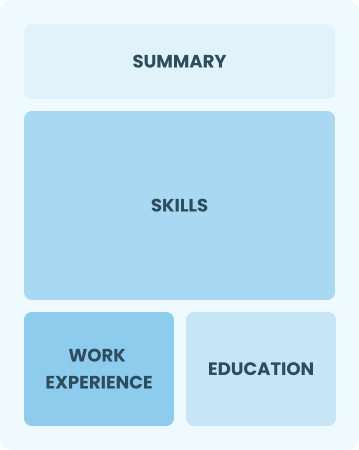

Resume Format Examples

Selecting the appropriate resume format is important as it highlights your relevant skills, experiences, and career growth in a way that catches the attention of potential employers.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with limited experience in insurance

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on demonstrating their skills and growth potential

Chronological

Emphasizes work history in reverse order

Best for:

Leaders in risk management and strategic insurance solutions

Insurance Salaries in the Highest-Paid States

Our insurance salary data is based on figures from the U.S. Bureau of Labor Statistics (BLS), the authoritative source for employment trends and wage information nationwide.

Whether you're entering the workforce or considering a move to a new city or state, this data can help you gauge what fair compensation looks like for insurances in your desired area.

Frequently Asked Questions

Should I include a cover letter with my insurance resume?

Absolutely. Including a cover letter can significantly improve your application by showcasing your personality and enthusiasm for the position. It allows you to highlight relevant skills and experiences that may not be evident in your resume. If you're looking for assistance, our guide on how to write a cover letter or our Cover Letter Generator can help you create a compelling one quickly.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs abroad, a CV is often required instead of a resume. This document provides an in-depth overview of your academic and professional background. Use our CV examples to explore effective formatting and discover how to craft a compelling CV that aligns with international expectations by learning how to write a CV.

What soft skills are important for insurances?

Soft skills such as communication, problem-solving, and empathy are essential in insurance. These interpersonal skills foster trust with clients and improve collaboration within teams, enabling smoother processes and better customer service.

I’m transitioning from another field. How should I highlight my experience?

When applying for insurance positions, highlight your transferable skills such as communication, teamwork, and analytical thinking. These competencies illustrate your ability to adapt and excel in new environments. Share specific instances from your past roles that showcase how these strengths align with the responsibilities in the insurance sector to demonstrate your value even if you lack direct experience.

How should I format a cover letter for a insurance job?

To format a cover letter, begin with your name and contact details. Follow this with a professional greeting, an engaging introduction, and a concise summary of your relevant skills. It's important to align your content with the job description for insurance roles. Conclude with a strong call to action that invites further discussion.

Should I include a personal mission statement on my insurance resume?

Yes, including a personal mission statement on your resume is recommended. This element effectively conveys your core values and career aspirations. It works particularly well for companies that emphasize mission-driven cultures or prioritize alignment with their organizational values.