Hard skills include technical, measurable abilities such as tax law knowledge, financial analysis, and skill in accounting software that a tax manager needs to possess.

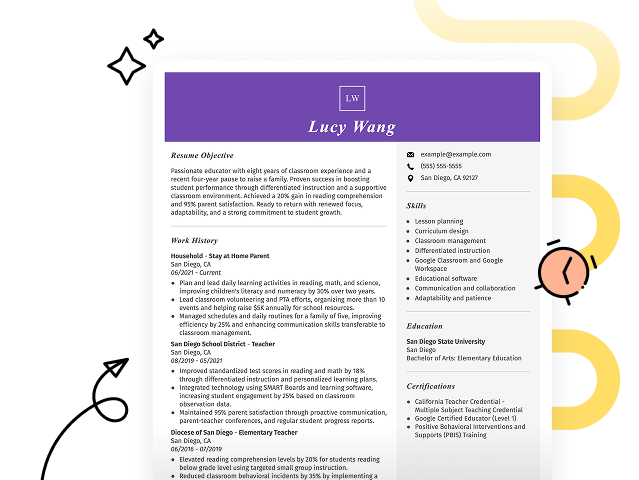

Popular Tax Manager Resume Examples

Check out our top tax manager resume examples that demonstrate key skills such as tax compliance, strategic planning, and financial analysis. These examples will help you effectively highlight your expertise to potential employers.

If you're looking to build your own impressive resume, our Resume Builder offers user-friendly templates designed specifically for finance professionals, making the process straightforward and efficient.

Recommended

Entry-level tax manager resume

This entry-level resume for a tax manager effectively showcases the job seeker's strong foundation in tax planning and compliance, as well as significant achievements during their previous roles. New professionals in this field must demonstrate analytical skills, attention to detail, and a solid understanding of tax regulations to appeal to potential employers, even with limited direct experience.

Mid-career tax manager resume

This resume effectively showcases qualifications by detailing effective results and leadership experiences. The strategic presentation of achievements illustrates the job seeker's readiness for complex challenges, reflecting a robust career trajectory in tax management and compliance.

Experienced tax manager resume

This resume demonstrates the applicant's expertise as a tax manager, emphasizing their ability to manage $250M in assets and achieve a 15% annual reduction in tax liabilities. The bullet points improve readability, making it easy for hiring managers to identify key accomplishments quickly.

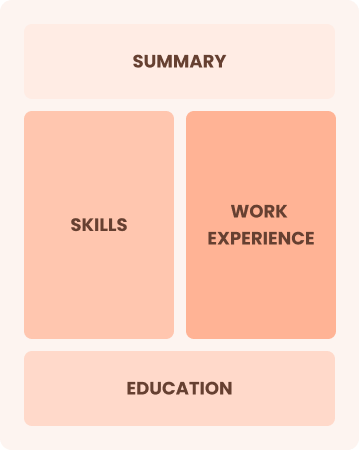

Resume Template—Easy to Copy & Paste

Min Zhang

Albany, NY 12206

(555)555-5555

Min.Zhang@example.com

Professional Summary

Dynamic Tax Manager skilled in optimizing processes, leading teams, and enhancing compliance. Proven record of reducing liabilities and improving client satisfaction.

Work History

Tax Manager

Pinnacle Financial Services - Albany, NY

June 2023 - October 2025

- Reduced tax liabilities by 15%

- Managed tax audits with a 100% success rate

- Optimized tax processes, cutting time by 20%

Senior Tax Analyst

Elite Tax Solutions - Buffalo, NY

June 2019 - May 2023

- Enhanced compliance accuracy by 25%

- Streamlined reporting, reducing costs by k

- Led a team of 5 analysts in key projects

Tax Consultant

Prestige Accounting Firm - Hillcrest, NY

June 2017 - May 2019

- Prepared tax returns for 200+ clients

- Trained junior consultants, improving retention

- Reduced errors in returns by 40%

Skills

- Tax Compliance

- Financial Reporting

- Tax Planning

- Audit Management

- Risk Assessment

- Cost Reduction

- Team Leadership

- Process Improvement

Certifications

- Certified Public Accountant - California Board of Accountancy

- Certified Tax Advisor - National Tax Association

Education

Master of Science Taxation

Stanford University Stanford, CA

May 2017

Bachelor of Arts Accounting

University of California, Berkeley Berkeley, CA

May 2015

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- Mandarin - Intermediate (B1)

How to Write a Tax Manager Resume Summary

Your resume summary is the first impression you make on hiring managers, so it’s essential to showcase your qualifications effectively. As a tax manager, you should highlight your expertise in tax regulations, compliance, and financial analysis to stand out from the competition. To illustrate what makes an strong resume summary, we’ll provide examples that demonstrate effective strategies and common pitfalls:

I am a dedicated tax manager with many years of experience and a strong background in the field. I seek a position that allows me to use my expertise while contributing to the success of the company. A role that supports professional development and has a positive work culture is what I aim for. I believe my skills can greatly benefit your team.

- Lacks specific details about achievements or unique skills, making it sound generic

- Overemphasizes personal desires instead of highlighting contributions to potential employers

- Uses vague language such as 'many years' without quantifying experience or impact

Results-driven tax manager with over 8 years of experience in corporate tax compliance and planning. Successfully reduced clients' effective tax rates by an average of 20% through strategic tax planning and risk assessment initiatives. Proficient in federal and state tax regulations, advanced Excel modeling, and using tax software to streamline reporting processes.

- Begins with a clear indication of experience level and area of expertise

- Highlights quantifiable achievements that showcase significant impact on client financial outcomes

- Enumerates specific technical skills that are important for success in the tax management field

Pro Tip

Showcasing Your Work Experience

The work experience section is the cornerstone of your resume as a tax manager. This area will contain the bulk of your content, and good resume templates always emphasize its importance.

In this section, you'll organize your past positions in reverse-chronological order, detailing your achievements through bullet points for clarity. Each role should highlight key contributions that demonstrate your expertise in tax management.

To further illustrate effective strategies, we'll present a couple of examples that show what works and what doesn’t in crafting compelling work history entries.

Tax Manager

Smith & Co. Accounting – New York, NY

- Managed tax returns for clients.

- Reviewed financial statements.

- Communicated with clients about tax matters.

- Ensured compliance with tax regulations.

- Lacks specific employment dates which are critical for context

- Bullet points do not highlight any achievements or measurable impact

- Focuses on routine tasks instead of showcasing expertise and leadership in tax management

Tax Manager

Smith & Co. Accounting – New York, NY

March 2020 - Present

- Lead a team of tax professionals in delivering comprehensive tax planning and compliance services for over 50 clients.

- Implemented new software solutions that increased efficiency by 30%, reducing turnaround time on tax returns.

- Developed training programs for junior staff, improving their technical skills and contributing to a 15% increase in overall team productivity.

- Uses powerful action verbs to clearly convey the applicant's contributions and leadership

- Incorporates specific metrics to highlight the impact of initiatives on efficiency and productivity

- Emphasizes relevant skills such as team leadership and client management in the context of accomplishments

While your resume summary and work experience are important, don’t overlook the importance of other sections that contribute to a professional presentation. Each part deserves careful attention. For more insights on crafting an effective resume, refer to our detailed guide on how to write a resume.

Top Skills to Include on Your Resume

A well-defined skills section is important for a tax manager's resume. It allows you to present your qualifications at a glance, making it easier for employers to see that you possess the necessary expertise.

In this role, highlight both technical skills and soft skills. For example, skill in software like QuickBooks or TaxSlayer, along with strong analytical abilities and attention to detail, will demonstrate your capability to manage complex tax scenarios effectively.

Soft skills encompass interpersonal qualities like attention to detail, effective communication, and problem-solving, which foster collaboration with clients and ensure accurate tax compliance.

Selecting the right resume skills is important as it can determine whether your application gets noticed by employers and passes through automated screening systems. Employers often use these systems to streamline the hiring process, so aligning your skills with their expectations is essential.

To effectively prioritize which skills to include, carefully review job postings for insights. This will help you highlight the most relevant skills that catch recruiters' attention and ensure compatibility with ATS requirements.

Pro Tip

10 skills that appear on successful tax manager resumes

To catch the attention of recruiters, highlight the most sought-after skills for tax manager positions in your resume. These essential skills are showcased in our resume examples, helping you present yourself with confidence.

By the way, here are 10 skills that you should consider adding to your resume if they align with your experience and job requirements:

Tax compliance knowledge

Analytical thinking

Attention to detail

Communication skills

Problem-solving abilities

Skill in tax software

Financial reporting expertise

Project management skills

Team leadership capabilities

Adaptability to changing regulations

Based on analysis of 5,000+ finance professional resumes from 2023-2024

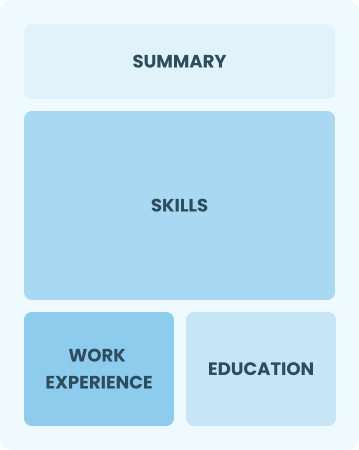

Resume Format Examples

Choosing the appropriate resume format is important for a tax manager as it highlights your financial expertise, relevant experiences, and career growth clearly and effectively.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with up to two years of experience

Combination

Balances skills and work history equally

Best for:

Mid-career managers focused on demonstrating their skills and growth potential

Chronological

Emphasizes work history in reverse order

Best for:

Tax leaders proficient in complex compliance and strategic planning

Frequently Asked Questions

Should I include a cover letter with my tax manager resume?

Absolutely, including a cover letter is a great way to improve your application. It allows you to showcase your personality and explain how your skills align with the job. To help you get started, check out our comprehensive guide on how to write a cover letter or use our Cover Letter Generator for quick assistance.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs abroad, use a CV instead of a resume as it is often the preferred format. A CV provides a comprehensive overview of your education and experience. For assistance with formatting and crafting an effective CV, explore our CV examples tailored to international standards. You can also learn more about how to write a CV.

What soft skills are important for tax managers?

Soft skills such as communication, problem-solving, and attention to detail are essential for tax managers. These interpersonal skills help promote collaboration with clients and colleagues, ensuring accurate financial reporting and building trust in professional relationships.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills like analytical thinking, attention to detail, and effective communication. These qualities are valuable in a tax manager role, even if your previous experience is in a different field. Use concrete examples from past jobs to illustrate how you've successfully navigated complex situations that align with tax management responsibilities.

Where can I find inspiration for writing my cover letter as a tax manager?

For those pursuing tax manager roles, exploring professionally crafted cover letter examples can be incredibly beneficial. These samples provide valuable insights into content ideas, formatting strategies, and effective ways to showcase your qualifications. Using them as inspiration can significantly improve your application materials.

Should I use a cover letter template?

Yes, using a cover letter template tailored for tax managers is advisable. It provides a clear structure and organizes your achievements in tax compliance and financial analysis effectively, showcasing relevant skills such as expertise in tax law and strategic planning to hiring managers.