Expertise in hard skills like law enforcement procedures, crisis management, and tactical operations is essential for an officer to ensure public safety.

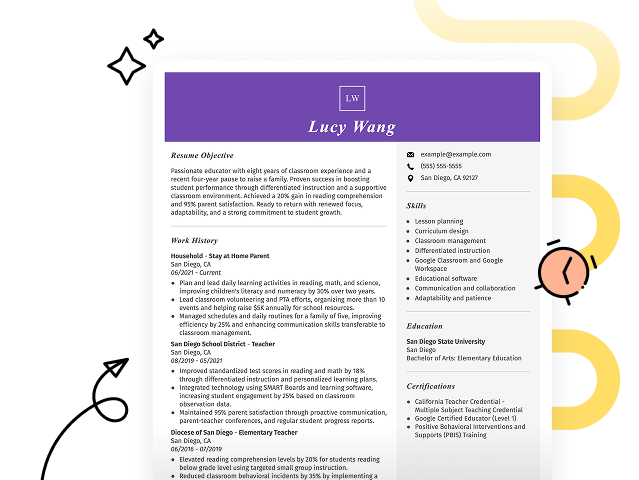

Popular Officer Resume Examples

Discover our top officer resume examples that emphasize key skills such as leadership, communication, and problem-solving. These examples will help you effectively showcase your qualifications and achievements in a competitive field.

Ready to build your ideal resume? Our Resume Builder offers user-friendly templates designed specifically for professionals looking to make an impact in their careers.

Recommended

Entry-level officer resume

This entry-level resume for an officer highlights the job seeker’s strong leadership skills and successful implementation of cost-saving measures within logistics. New professionals in this field must effectively demonstrate their ability to manage teams, optimize processes, and adhere to safety standards, showcasing relevant achievements even with limited direct experience.

Mid-career officer resume

This resume effectively showcases the job seeker's qualifications through quantifiable achievements and leadership roles. Each position emphasizes their capability to drive operational improvements, demonstrating a clear trajectory towards increased responsibility and strategic influence in the business sector.

Experienced officer resume

This resume illustrates the applicant's strong leadership capabilities, with notable achievements such as improving efficiency by 25% and saving $10K annually through budget management. The bullet points effectively highlight these accomplishments, making it easy for hiring managers to recognize the applicant's impact.

Resume Template—Easy to Copy & Paste

Sophia Singh

Miami, FL 33101

(555)555-5555

Sophia.Singh@example.com

Professional Summary

Dynamic business officer with expertise in project coordination, strategic planning, and client satisfaction. Proven track record in cost reduction and team leadership, enhancing workflow efficiency.

Work History

Officer

Strategic Solutions, Inc. - Miami, FL

June 2022 - November 2025

- Implemented cost-saving strategies, reducing expenses by 15%

- Coordinated team projects to enhance client satisfaction by 10%

- Led cross-departmental meetings, optimizing workflow efficiency

Project Coordinator

NextGen Innovations - Riverview, FL

June 2020 - June 2022

- Developed project plans, increasing timeline accuracy

- Facilitated stakeholder engagements, raised funding by k

- Streamlined process workflows, improving productivity by 20%

Operations Associate

Bayside Enterprises - Miami, FL

June 2018 - June 2020

- Managed budgets, ensuring compliance with financial goals

- Optimized client logistics, leading to 25% faster delivery

- Implemented quality assurance checks, reducing errors by 30%

Languages

- Spanish - Beginner (A1)

- French - Bilingual or Proficient (C2)

- German - Beginner (A1)

Skills

- Project Management

- Strategic Planning

- Team Leadership

- Workflow Optimization

- Cross-functional Collaboration

- Budget Management

- Quality Assurance

- Client Coordination

Certifications

- Certified Project Manager - International Project Management Institute

- Business Operations Certification - Global Business Education Network

Education

Master of Business Administration Business Management

University of Illinois Chicago, Illinois

September 2018

Bachelor of Science Operations Management

Illinois State University Normal, Illinois

September 2016

How to Write an Officer Resume Summary

Your resume summary is the first thing employers will notice, making it essential to create a strong impression. This section should clearly convey your qualifications and what makes you a standout applicant for the officer role.

As an officer, you should highlight your leadership skills, decision-making abilities, and commitment to service. These qualities reflect your readiness to take on responsibilities in this dynamic field.

To illustrate effective summaries, we will provide examples that demonstrate both successful and less effective approaches:

I am an experienced officer with a diverse background in law enforcement. I want to find a position where I can make a difference and help my community. A job that offers good benefits and career advancement would be great for me. I believe I have the skills to contribute positively if given the chance.

- Lacks specific examples of skills or accomplishments, making it difficult for employers to assess qualifications

- Emphasizes personal desires over the value provided to potential employers, which is less appealing

- Contains generic phrases that do not differentiate the applicant from others in similar roles

Results-driven officer with 7+ years of experience in law enforcement, specializing in community policing and crime prevention strategies. Successfully decreased local crime rates by 20% through the implementation of proactive patrol initiatives and community engagement programs. Proficient in conflict resolution, investigation techniques, and using advanced technology for data analysis.

- Begins with specific years of experience and areas of expertise relevant to the role

- Includes a quantifiable achievement that highlights a significant impact on community safety

- Demonstrates skill in relevant skills that are important for effective law enforcement

Pro Tip

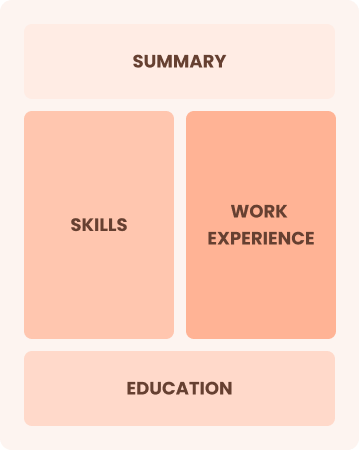

Showcasing Your Work Experience

The work experience section is important for your resume as an officer, containing the majority of your content. Good resume templates always emphasize this important area to highlight relevant experiences.

This section should be organized in reverse-chronological order, detailing your previous roles. Use bullet points to succinctly showcase your accomplishments and responsibilities in each position.

To help you excel, we’ve prepared a couple of examples that illustrate effective entries for officers. These examples will clearly demonstrate what works well and what pitfalls to avoid.

Officer

City Police Department – Springfield, IL

- Patrolled neighborhoods for safety.

- Responded to calls and reports.

- Worked with a team of officers.

- Filled out reports and maintained logs.

- No details about the employment dates

- Bullet points are vague and lack specific achievements

- Focuses on routine duties instead of effective contributions

Security Officer

Guardian Security Services – Los Angeles, CA

March 2020 - Present

- Monitor and secure premises of a 50-floor commercial building, reducing incidents by 30% through proactive patrolling.

- Implement emergency response protocols during critical situations, ensuring the safety of over 1,000 occupants daily.

- Train new security personnel in safety procedures and technology usage, improving team efficiency by 20%.

- Each bullet point starts with a powerful action verbs that highlights key achievements

- Incorporates specific metrics to demonstrate quantifiable improvements made by the job seeker

- Emphasizes relevant skills such as emergency management and training capabilities

While your resume summary and work experience are important components, don't overlook the importance of other sections that play an important role in showcasing your qualifications. For detailed guidance on crafting an effective resume, refer to our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important for any effective resume because it allows hiring managers to quickly see if you have the essential qualifications and capabilities for the officer role.

For an officer, focus on both technical skills and interpersonal abilities. Highlight your skill in systems like incident reporting software or community policing tools, along with communication and conflict resolution skills that are critical in this field.

Additionally, soft skills such as communication, empathy, and teamwork play a key role in building community trust and collaborating effectively with colleagues.

Choosing the right resume skills is important because employers often seek specific competencies that align with their expectations. Additionally, many companies use automated systems to filter out applicants who lack these essential skills.

To improve your chances of getting noticed, take time to review job postings closely. They often reveal the key skills you should highlight on your resume to impress both recruiters and ATS systems.

Pro Tip

10 skills that appear on successful officer resumes

Highlighting sought-after skills on your resume is important for capturing the attention of recruiters in officer positions. You can find these abilities reflected in resume examples, giving you the confidence to present yourself professionally.

Here are 10 essential skills you might consider adding to your resume if they align with your qualifications and job needs:

Leadership

Attention to detail

Time management

Problem-solving

Team collaboration

Crisis management

Communication skill

Analytical thinking

Ethical judgment

Adaptability

Based on analysis of 5,000+ law enforcement professional resumes from 2023-2024

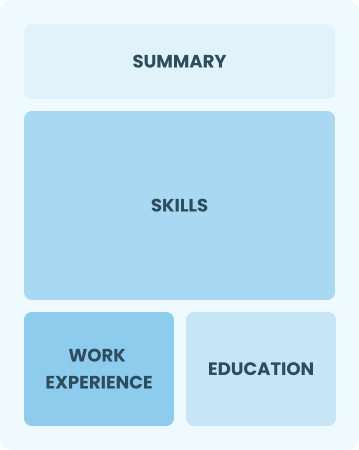

Resume Format Examples

Choosing the right resume format is essential because it highlights your key skills and experiences, making sure your career progression catches the attention of potential employers.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with limited experience in the field

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on highlighting their skills and growth potential

Chronological

Emphasizes work history in reverse order

Best for:

Seasoned leaders excelling in strategic healthcare management roles

Officer Salaries in the Highest-Paid States

Our officer salary data is based on figures from the U.S. Bureau of Labor Statistics (BLS), the authoritative source for employment trends and wage information nationwide.

Whether you're entering the workforce or considering a move to a new city or state, this data can help you gauge what fair compensation looks like for officers in your desired area.

Frequently Asked Questions

Should I include a cover letter with my officer resume?

Absolutely, including a cover letter can greatly improve your application by allowing you to showcase your personality and explain how your skills align with the job. To get started, explore our comprehensive guide on how to write a cover letter or use our handy Cover Letter Generator for quick assistance. These resources will help you make a memorable impression on hiring managers.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs outside the U.S., a CV is often required instead of a resume. A CV provides a detailed overview of your academic and professional history. To learn how to write a CV, explore our comprehensive resources designed for international job seekers, or check out various CV examples for formatting and crafting guidance.

What soft skills are important for officers?

Soft skills such as communication, conflict resolution, and teamwork are essential for officers. These interpersonal skills foster trust within the community and improve collaboration with colleagues, ultimately leading to more effective policing and stronger community relationships.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as communication, teamwork, and adaptability from previous roles. These abilities prove your potential value, even if you lack direct experience in the field. Share concrete examples that illustrate how your past successes align with the responsibilities of an officer position to showcase your readiness and commitment.

How should I format a cover letter for a officer job?

To format a cover letter for officer positions, start by including your contact details. Follow this step with a professional salutation and an engaging introduction that ties your experience to the role. Provide a concise summary of your skills while ensuring the content is customized to meet the job requirements. Conclude with a strong closing statement that encourages further communication.

Should I use a cover letter template?

Yes, using a cover letter template tailored for nursing can improve the structure of your letter. This approach ensures that you effectively organize content and highlight critical skills such as patient care, clinical expertise, and teamwork that resonate with hiring managers.