It is important for a debt collector to highlight their hard skills, which include specific technical abilities like knowledge of credit laws, negotiation techniques, and skill in collection software.

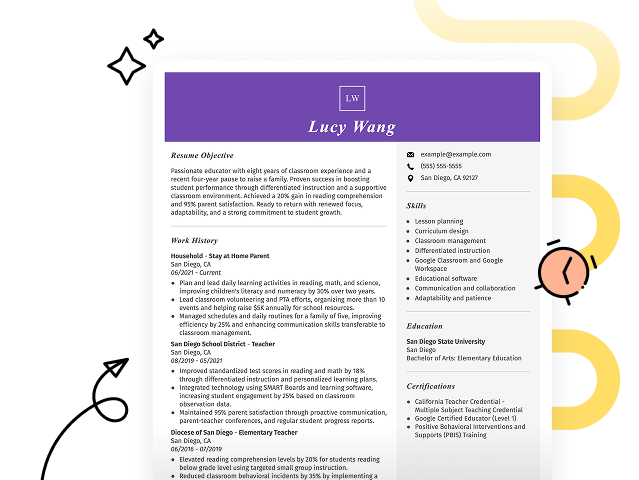

Popular Debt Collector Resume Examples

Check out our top debt collector resume examples that emphasize critical skills such as negotiation, communication, and problem-solving. These resumes demonstrate effective ways to showcase your accomplishments and stand out to potential employers.

Ready to build your ideal resume? Our Resume Builder offers user-friendly templates designed specifically for finance professionals, helping you make a great impression in your job applications.

Recommended

Entry-level debt collector resume

This entry-level resume highlights the job seeker's achievements in debt recovery, showcasing a strong background in negotiation and financial analysis. New professionals in the debt collection field must demonstrate their ability to manage accounts efficiently and implement innovative strategies, even with limited experience.

Mid-career debt collector resume

This resume strategically outlines key qualifications, showcasing the applicant's proven track record in debt recovery and negotiation. The emphasis on performance metrics highlights readiness for advanced roles, demonstrating skill in analytics and conflict resolution.

Experienced debt collector resume

This section demonstrates the applicant's robust experience in debt collection, highlighting a 15% annual increase in recovery rates and managing $500,000 in accounts. The clear bullet points improve readability, making it easy for hiring managers to identify key accomplishments quickly.

Resume Template—Easy to Copy & Paste

Hiro Lee

Eastside, WA 98003

(555)555-5555

Hiro.Lee@example.com

Professional Summary

Experienced debt collector skilled in recovery rates, negotiating client payment plans, and reducing delinquent debt through strategic financial analysis.

Work History

Debt Collector

Credit Solutions Group - Eastside, WA

June 2022 - September 2025

- Recovered 85% of overdue accounts monthly

- Negotiated 30+ payment plans effectively

- Reduced client debt by 150K annually

Collections Specialist

Financial Recovery Experts - Spokane, WA

March 2018 - May 2022

- Achieved 40% increase in recovery rates

- Managed a 2M portfolio of delinquent accounts

- Developed strategies to reduce debt by 20%

Accounts Receivable Coordinator

Debt Management Services - Seattle, WA

January 2016 - February 2018

- Processed 200+ invoices weekly

- Maintained a 95% client satisfaction rate

- Streamlined billing, raising collection by 15%

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Skills

- Account recovery

- Negotiation

- Debt management

- Client communication

- Portfolio management

- Financial analysis

- Problem-solving

- Conflict resolution

Certifications

- Certified Credit and Collection Manager - American Credit and Collection Association

- Debt Management Professional - National Financial Services Association

Education

Master of Business Administration Finance

University of Massachusetts Boston, MA

June 2016

Bachelor of Science Accounting

Boston College Chestnut Hill, MA

June 2014

How to Write a Debt Collector Resume Summary

Your resume summary is the first opportunity to capture an employer's attention, making it a critical part of your application. As a debt collector, it's essential to highlight your negotiation skills and ability to communicate effectively while maintaining professionalism.

This profession should emphasize your experience in managing accounts, resolving disputes, and achieving collection targets. Showcasing your results-driven approach will set you apart from other applicants.

To illustrate what works in this key section, consider these examples of effective debt collector resume summaries:

I am an experienced debt collector with many years in the field. I want to find a job where I can use my skills and help the company make more money. A place that values its employees and offers good benefits would be perfect for me. I believe I can make a difference if given the chance.

- Lacks specific achievements or skills relevant to debt collection, making it vague.

- Focuses heavily on personal desires instead of what the applicant can contribute to potential employers.

- Uses generic phrases that do not stand out or demonstrate unique qualifications.

Results-driven debt collector with over 6 years of experience in consumer debt recovery, specializing in high-volume accounts and customer resolution. Successfully increased collections by 20% year-over-year through effective negotiation strategies and relationship management. Proficient in collection software, skip tracing techniques, and compliance with FDCPA regulations to ensure ethical practices.

- Begins with clear years of experience and specific area of expertise in debt collection.

- Highlights quantifiable achievement that demonstrates a significant impact on the organization's collections performance.

- Includes relevant technical skills and knowledge of industry regulations that are critical for employers.

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as a debt collector, serving as the primary focus of your content. Good resume templates are designed to emphasize this section to highlight your relevant experience.

This area should be organized in reverse-chronological order, detailing your previous positions. It's recommended to use bullet points to illustrate effectively your key achievements and contributions in each role.

Now, let’s look at some examples that can guide you on how to present your work history as a debt collector. These examples will clarify what makes an effective entry and help you avoid common pitfalls.

Debt Collector

XYZ Collections Agency – New York, NY

- Called clients about their debts.

- Recorded payments and updated accounts.

- Communicated with team members.

- Followed up on outstanding accounts.

- No details about the employment dates.

- Bullet points are too vague and lack specific achievements.

- Emphasizes routine tasks instead of showcasing results like collections success rates.

Debt Collector

Credit Solutions Inc. – Atlanta, GA

March 2020 - Current

- Successfully negotiated repayment plans for over 200 clients, recovering an average of 75% of outstanding debts within a six-month period.

- Used effective communication strategies to resolve disputes, achieving a customer satisfaction rate of 90%.

- Trained new hires on compliance regulations and negotiation techniques, improving team performance by 30%.

- Starts each bullet with dynamic action verbs that clearly state the job seeker’s achievements.

- Incorporates specific metrics to quantify success and demonstrate results.

- Highlights relevant skills such as negotiation and training that are critical in the debt collection field.

While your resume summary and work experience are important components, don't overlook the importance of other sections that contribute to a well-rounded presentation. For more insights and detailed guidance, explore how to write a resume to create an effective document.

Top Skills to Include on Your Resume

A skills section is important for a debt collector's resume as it showcases your qualifications and suitability for the role. It allows potential employers to quickly identify if you possess the necessary abilities to excel in their environment.

For this profession, you'll want to highlight a mix of hard skills and soft skills. Touching on a diverse range of skills make for a more appealing application.

Equally important are soft skills, such as communication, empathy, and patience, which facilitate effective interactions with clients and improve the resolution process.

When selecting skills for your resume, aligning with what employers expect from ideal applicants is important. Many businesses use systems that filter out applicants lacking essential resume skills, so ensure yours get noticed.

To effectively highlight the right skills, examine job postings closely for insights into what recruiters desire. This strategy will not only help you attract attention but also increase your chances of passing through automated screening processes.

Pro Tip

10 skills that appear on successful debt collector resumes

Highlighting essential skills on your resume can significantly increase your chances of catching the eye of recruiters in the debt collection field. Our resume examples showcase these high-demand abilities, empowering you to approach job applications with confidence.

Here are 10 skills you should consider including in your resume if they align with your experience and job requirements:

Negotiation

Communication

Problem-solving

Time management

Attention to detail

Customer service

Data entry accuracy

Conflict resolution

Financial literacy

Familiarity with collection software

Based on analysis of 5,000+ accounting professional resumes from 2023-2024

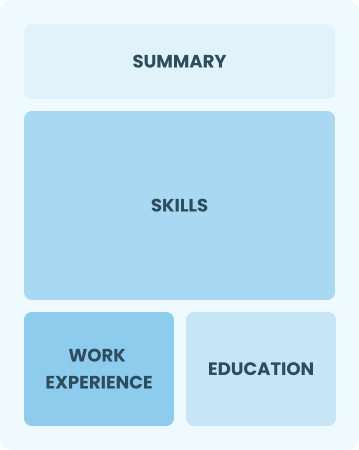

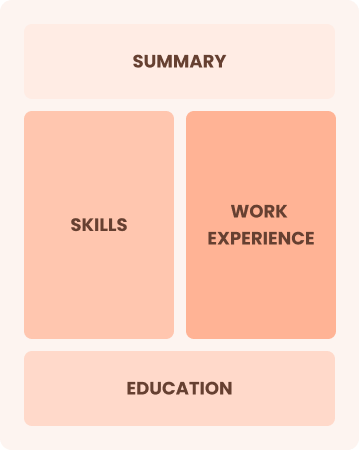

Resume Format Examples

Choosing the appropriate resume format is important for debt collectors, as it effectively showcases your negotiation skills, experience in financial recovery, and professional growth to potential employers.

Functional

Focuses on skills rather than previous jobs.

Best for:

Recent graduates and career changers with up to two years of experience.

Combination

Balances skills and work history equally.

Best for:

Mid-career professionals focused on pursuing growth opportunities.

Chronological

Emphasizes work history in reverse order.

Best for:

Seasoned debt collectors excelling in negotiation and team leadership.

Frequently Asked Questions

Should I include a cover letter with my debt collector resume?

Absolutely. Including a cover letter improves your application by showcasing your personality and detailing your relevant skills. It offers you a chance to connect with potential employers on a personal level. For assistance, explore our comprehensive guide on how to write a cover letter or use our Cover Letter Generator for quick and easy customization.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs outside the U.S., use a CV instead of a resume as it typically offers more detailed information about your academic and professional experience. Explore our resources on how to write a CV and check out these CV examples to ensure your application stands out internationally.

What soft skills are important for debt collectors?

Soft skills such as active listening, empathy, and negotiation are essential for debt collectors. These interpersonal skills facilitate effective communication with clients, foster trust, and help resolve disputes amicably, leading to improved payment outcomes while maintaining positive relationships.

I’m transitioning from another field. How should I highlight my experience?

Highlight skills such as negotiation, communication, and conflict resolution from your previous roles. These abilities are transferable skills and show your potential value to employers, even if you lack direct experience. Use concrete examples from past jobs to illustrate how you've successfully navigated challenging situations and achieved results relevant to this field.

Should I use a cover letter template?

Yes, using a cover letter template for debt collectors ensures a structured presentation that highlights essential negotiation skills and experience in managing accounts receivables effectively, helping your application stand out to hiring managers.

How do I write a resume with no experience?

Even if you have limited work experience, you can still shine when applying for debt collector positions. To write a resume with no experience, highlight your skills in negotiation, communication, and problem-solving. Share any relevant volunteer work or coursework that involved customer service or financial literacy. Employers appreciate your eagerness to learn and grow, so let your passion for the role come through.