Hard skills include skill in medical coding, billing software navigation, and an understanding of insurance regulations essential for accurate claims processing.

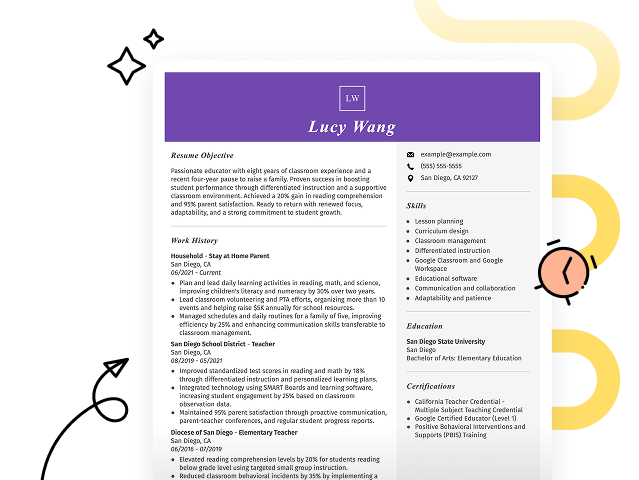

Popular Billing Clerk Resume Examples

Check out our top billing clerk resume examples that emphasize important skills like accuracy, attention to detail, and skill in billing software. These templates will help you showcase your qualifications effectively to potential employers.

Want to build your own impressive resume? Our Resume Builder offers user-friendly templates specifically designed for billing professionals, making the process quick and easy.

Recommended

Entry-level billing clerk resume

This entry-level resume highlights the job seeker's skill in managing invoices, reducing errors, and streamlining processes, showcasing a strong foundation in financial operations. New professionals in this field need to demonstrate their technical skills and attention to detail through quantifiable achievements and relevant certifications, even with limited work experience.

Mid-career billing clerk resume

This resume effectively highlights the job seeker's qualifications by showcasing measurable achievements in billing accuracy and operational efficiency. The structured presentation of skills reflects readiness for increased responsibilities and positions them as a strong job seeker for advanced roles in finance.

Experienced billing clerk resume

The work experience section demonstrates the applicant's extensive experience as a billing clerk, particularly their ability to manage over 500 client invoices quarterly while reducing billing inaccuracies by 25%. The clear bullet points improve readability, making it easy for hiring managers to identify key accomplishments quickly.

Resume Template—Easy to Copy & Paste

Suki Tanaka

Riverside, CA 92501

(555)555-5555

Suki.Tanaka@example.com

Professional Summary

Accomplished Billing Clerk with expertise in billing operations, accounts receivable, and financial reporting. Successfully optimized processes and reduced errors to improve efficiency, enhancing client satisfaction and bottom-line results.

Work History

Billing Clerk

Financial Solutions Agency - Riverside, CA

February 2023 - September 2025

- Processed 120K in monthly billing accurately

- Reduced billing errors by 30% via new procedures

- Administered accounts receivable for 100+ clients

Accounts Receivable Specialist

Integrity Financial Services - San Francisco, CA

February 2019 - January 2023

- Managed over 0K in client accounts monthly

- Improved collection process efficiency by 25%

- Collaborated with teams to resolve billing disputes

Invoice Coordinator

Trustworthy Associates Inc. - San Francisco, CA

February 2018 - January 2019

- Generated invoices totaling 250K monthly

- Coordinated with vendors to ensure timely payments

- Optimized invoicing process to decrease cycle times

Skills

- Billing Procedures

- Invoicing Systems

- Accounts Receivable

- Accounting Software

- Financial Reporting

- Error Reduction Strategies

- Client Account Management

- Team Collaboration

Certifications

- Certified Billing Specialist - American Billing Association

- Advanced Accounts Receivable Certification - Financial Operations Institute

- Invoice Management Certification - Institute of Financial Operations

Education

Master of Business Administration Finance

University of Illinois Urbana-Champaign, Illinois

May 2017

Bachelor of Science Accounting

Illinois State University Normal, Illinois

May 2015

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

How to Write a Billing Clerk Resume Summary

Your resume summary is the first thing employers will see, making it important to present a compelling snapshot of your qualifications. As a billing clerk, you should focus on showcasing your attention to detail and experience with financial transactions.

Highlight skills such as accuracy in data entry and skill in relevant software that demonstrate your capability in managing billing tasks efficiently.

To guide you in crafting a strong resume summary, the following examples will illustrate what works well and what pitfalls to avoid:

I am an experienced billing clerk with a long history in the field. I want to find a job where I can use my skills and be part of a successful team. A workplace that values employee satisfaction and offers chances for advancement is important to me. I believe I can contribute positively if given a chance.

- Contains broad statements about experience without any specific achievements or skills mentioned.

- Relies heavily on personal pronouns and general desires, making it less compelling.

- Emphasizes the applicant's wants over how they can add value to the employer's organization.

Detail-oriented billing clerk with over 4 years of experience in medical billing and coding, adept at processing insurance claims and patient invoices. Achieved a 98% claim approval rate by implementing systematic follow-up procedures and ensuring accurate coding. Proficient in using billing software and electronic health record (EHR) systems to streamline financial transactions and improve revenue cycle efficiency.

- Begins with the specific number of years of relevant experience in billing.

- Highlights a quantifiable achievement that showcases effectiveness in handling claims.

- Mentions technical skills that are essential for success in the billing role.

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as a billing clerk, where you'll present the majority of your content. Solid resume templates always emphasize this important section.

This part should be organized in reverse-chronological order, detailing your previous jobs clearly. Use bullet points to highlight your key achievements and contributions in each billing role.

Now, let's showcase a couple of examples that illustrate effective entries for billing clerks. These examples will clarify what makes an impact and what to avoid:

Billing Clerk

Acme Corp – Los Angeles, CA

- Processed billing information.

- Answered customer inquiries.

- Maintained records on the computer.

- Assisted in payment collections.

- No details about the employment dates.

- Bullet points are vague and do not highlight specific skills or achievements.

- Focuses on basic responsibilities rather than measurable outcomes or contributions.

Billing Clerk

ABC Medical Center – Los Angeles, CA

March 2020 - Current

- Manage patient billing accounts for over 200 clients, ensuring accuracy and timely processing of invoices.

- Implement a new electronic billing system that reduced invoice errors by 30%, improving overall efficiency.

- Collaborate with insurance companies to resolve claims disputes, achieving a 95% resolution rate within 30 days.

- Starts each bullet with action verbs to highlight specific achievements.

- Incorporates quantifiable results to clearly demonstrate the impact of the applicant's work.

- Showcases relevant skills such as system implementation and communication in resolving issues.

While your resume summary and work experience are important for showcasing your qualifications, don’t overlook the importance of other sections. Each part contributes to a complete picture of your skills. For further insights on crafting an effective resume, explore our detailed guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important for any strong resume as it allows you to showcase your qualifications at a glance. This helps employers quickly identify if you possess the essential abilities needed for the billing clerk position.

For this role, we recommend including a mix of hard and soft skills. Emphasizing a range of skills will help you appeal to hiring managers.

Soft skills encompass attention to detail, strong communication, and problem-solving abilities that foster effective interactions with patients and ensure smooth administrative operations within the healthcare team.

Selecting resume skills that align with employer expectations is important in today's job market. Many companies use automated systems to screen applications, so it's essential to include relevant skills to ensure your resume stands out.

To identify which skills to highlight, carefully examine the job postings. These often contain key phrases and requirements that recruiters and ATS systems prioritize, helping you tailor your resume effectively.

Pro Tip

10 skills that appear on successful billing clerk resumes

Improving your resume with key skills for billing clerk positions can greatly catch the eye of hiring managers. These sought-after abilities are showcased in our resume examples, giving you the advantage needed to land job interviews.

Here are 10 skills you should consider including in your resume if they align with your background and job specifications:

Attention to detail

Data entry skill

Customer service expertise

Basic accounting knowledge

Organizational abilities

Familiarity with billing software

Problem-solving skills

Communication skills

Time management

Adaptability

Based on analysis of 5,000+ accounting professional resumes from 2023-2024

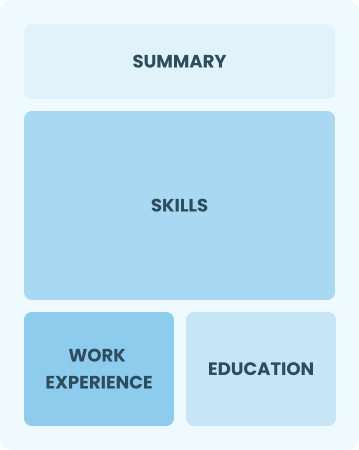

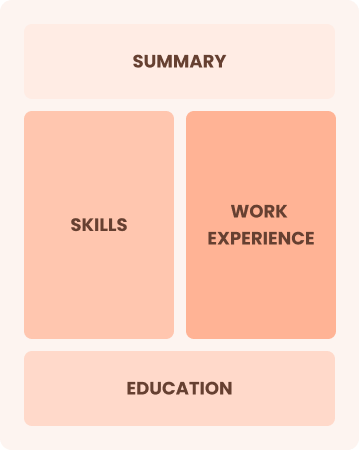

Resume Format Examples

Choosing the right resume format is important for billing clerks because it clearly highlights key skills, relevant experience, and career advancements.

Functional

Focuses on skills rather than previous jobs.

Best for:

Best for recent graduates and career changers with limited experience in billing.

Combination

Balances skills and work history equally.

Best for:

Mid-career professionals seeking to highlight their skills and growth potential.

Chronological

Emphasizes work history in reverse order.

Best for:

Skilled individuals with expertise in advanced billing systems and team leadership.

Frequently Asked Questions

Should I include a cover letter with my billing clerk resume?

Absolutely, including a cover letter can significantly improve your application. It allows you to highlight your unique skills and convey your enthusiasm for the position. If you need assistance, take a look at our helpful resources on how to write a cover letter or use our Cover Letter Generator for quick results.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs abroad, use a CV instead of a resume as it provides a comprehensive overview of your education and experience. For guidance on how to write a CV, explore our detailed resources designed to assist you in creating a standout application. Additionally, reviewing various CV examples can provide insights into effective formatting and content strategies.

What soft skills are important for billing clerks?

Soft skills are interpersonal skills like attention to detail and communication. These abilities enable accurate processing of transactions while promoting positive interactions with clients and colleagues. This ensures a smooth workflow and improves customer satisfaction.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills like attention to detail, organization, and effective communication when applying for billing clerk positions. These abilities show your readiness to excel in a new role despite limited experience in billing. Provide specific examples from past jobs that illustrate how these strengths directly relate to handling invoices and managing records effectively.

Where can I find inspiration for writing my cover letter as a billing clerk?

For billing clerk positions, reviewing cover letter examples can be incredibly beneficial. These samples provide inspiration for content ideas, formatting tips, and effective ways to showcase your qualifications. Use them as a guide to craft a compelling application that stands out to potential employers.

How do I add my resume to LinkedIn?

To improve your visibility, add your resume to LinkedIn by uploading it directly to your profile or highlighting key achievements in the "About" and "Experience" sections. This approach helps recruiters and hiring managers easily find qualified billing clerks like you.