How to Mention Salary Requirements on a Resume (With Real Examples)

If employers ask you to share your compensation expectations, you can do so in a resume, cover letter, or interview. Keep reading for tips and examples on how to navigate this tactfully.

While it’s not common to mention salary expectations upfront during the early stages of the job application process, some employers may ask for it in the job listing. In those cases, knowing how to add your salary requirements clearly and professionally will help you stand out and move forward in the hiring process with confidence.

In this guide, we’ll explain what salary expectations really mean, when and how to include them on a resume or cover letter, and provide real-world examples.

What Are Salary Requirements and Expectations?

Salary requirements (or salary expectations) refer to the compensation you’d need to accept a job offer, including base pay, benefits, and other perks. Employers might ask for this information in a job post using phrases like “include your salary requirements” or “state your expected salary.”

Your salary expectations should reflect a few key factors:

- Your work experience and skill level

- Educational requirements for the role

- The average pay for similar jobs in your area or industry

- The cost of living in your location

While the terms are often used interchangeably, “salary expectations” typically refer to a range you’d be happy with, while “salary requirements” can imply a minimum you’re willing to accept. Either way, it’s important to be thoughtful and realistic about these numbers, especially if an employer requests this information early in the hiring process.

Where Should You Include Salary Information

Only include salary requirements or expectations if the employer specifically asks for them. When they do, you have a few options depending on the format of the job application:

In your resume: Add a single line near the end of your resume after your education section. Keep it brief and professional (e.g., “Expected salary: $60,000–$70,000 annually, negotiable.”).

In your cover letter: If the job post mentions salary expectations, it’s often best to address them in the final paragraph of your cover letter, giving you room to provide context for your range and if there’s flexibility.

In an application form: Some employers provide a specific field for salary requirements. Use a range if possible and note that your salary is negotiable based on the full compensation package.

Avoid listing salary expectations in your resume or cover letter unless requested, since doing so unnecessarily can limit your negotiating power or disqualify you early.

If you’re ready to build a strong job application packet, start by writing a compelling resume with the help of our Resume Builder. Simply list your target role and experience level, and the builder will generate a personalized resume in no time!

Where To Put Salary Requirements in a Resume

When it comes to adding salary requirements in a resume, you want to ensure you don’t put it in the summary or too high up on the document and risk overshadowing your accomplishments. The best place to put salary requirements in a resume is towards the end of the document.

Here’s how to format it:

- Keep it to one line.

- Use a range if possible, such as, “Expected salary: $55,000–$65,000 annually.”

- If you're flexible, mention that it's negotiable.

Example:

Expected Salary: $60,000–$70,000 annually, negotiable based on total compensation package.

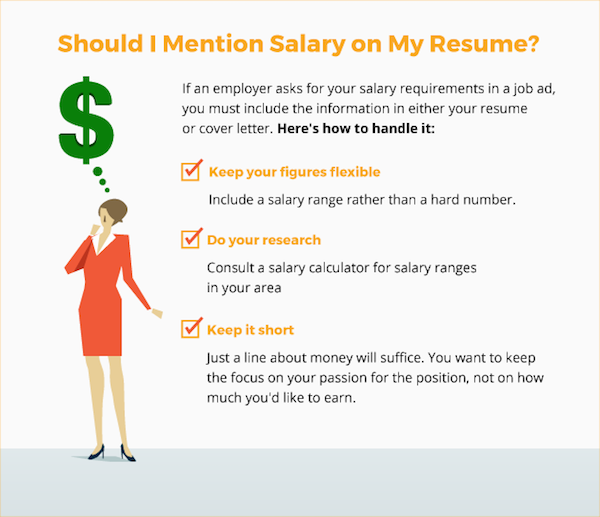

Tips for Including Salary Expectations in Your Resume

If an employer asks you to include salary expectations in your resume, it’s important to handle it carefully. You want to be transparent without limiting your negotiating power or drawing focus away from your qualifications. These tips will help you do just that:

- Research industry salary standards

Before you list a number, research the industry wage standards to see what professionals with similar experience and roles typically earn in your location. Use salary calculators or job market tools that consider your job title, education level, years of experience, and ZIP code. Always tailor your range to the industry and region to stay competitive. - Use a flexible salary range

Rather than giving a single number, include a reasonable range. Choose a minimum that you’d be comfortable with and a top-end that reflects your ideal outcome. - Mention that salary is negotiable (if true)

Adding a brief statement about flexibility can show that you’re open to the full compensation package, including benefits, bonuses, or professional development opportunities. - Customize for each role

Different companies and locations offer different compensation levels. A startup in a major city may offer a different package than a midsize company in a smaller market. Adjust your range accordingly for each application. - Keep it brief and low-profile

Salary details should not take up much space. Limit your statement to one line, and place it at the end of your resume. Let your qualifications do most of the talking.

Pro Tip

Samples of Resume Salary Expectations

If you're asked to include salary expectations in your resume, keep your statement concise, professional, and tailored to the role. Avoid overexplaining and taking up valuable resume space, your resume should always focus on your qualifications, not compensation.

Here are a few examples you can tweak:

Example for standard salary range

Expected salary: $55,000–$65,000 annually, negotiable based on overall compensation package.

Example for emphasizing flexibility

Salary requirements: Flexible, depending on benefits, growth opportunities, and job responsibilities.

Example for minimum requirement

Minimum salary requirement: $60,000 annually.

Example for position-specific range

For a mid-level marketing role, expected salary is in the range of $70,000–$80,000, based on industry standards and experience.

Examples of Salary Expectations in a Cover Letter

When a job posting asks for your salary expectations, the best place to include them is in the final paragraph of your cover letter. This allows you to first highlight your qualifications and enthusiasm for the role, and then briefly mention your expected salary in a professional, non-demanding tone.

Here are a few examples of how to phrase salary expectations in a cover letter:

Example 1: Be direct but flexible

Based on my experience and the requirements of the role, my salary expectation is in the range of $60,000 to $70,000 annually. However, I am open to discussion depending on the overall compensation package.

Example 2: Emphasizing research and fit

After researching similar roles in the industry and considering my background, I would expect a salary in the range of $50,000 to $60,000. That said, I’m flexible and willing to negotiate based on the complete benefits package and advancement opportunities.

Example 3: Stating a minimum (if needed)

My minimum salary requirement is $65,000 annually, though I remain open to negotiation depending on the responsibilities and benefits associated with the role.

Tips for including salary in a cover etter:

- Keep your salary statement brief. Just one or two sentences is enough.

- Be realistic and informed: base your range on research.

- Show flexibility if possible, unless you have a firm minimum.

- Always respond to the employer’s instructions if they request salary info.

How to Answer Salary Expectations in Job Interviews

When an interviewer asks about your salary expectations, they’re trying to gauge two things: whether your expectations align with their budget and whether you’ve done your homework.

When answering this common job interview question, a lot of the tips for including salary expectations in your resume or cover letter apply to answering it in a job interview. Always research your answer beforehand and offer up a reasonable and negotiable salary range.

When it comes to tone and execution, strike a balance between being confident in your value and showing flexibility.

Here are a few additional tips:

Turn the question around (if appropriate)

If you're early in the interview process and don't have enough details about the role, it's okay to politely redirect.

Example:

“I’d like to learn more about the role’s responsibilities and expectations before discussing salary, but I’m sure we can agree on a number that’s fair for both sides.”

Enter text here...

Don’t give a number without doing research

Throwing out a number without understanding the market rate for the role can backfire. If you aim too high, you may price yourself out of the position. Too low, and you risk undervaluing your experience or getting stuck with a lower offer. Always come to the conversation with a salary range backed by real data from trusted sources.

Avoid saying “I’m not sure” or “Whatever you think is fair”

Vague answers make you seem unprepared or unsure of your worth. Employers may interpret them as a lack of confidence or professionalism. Instead, even if you’re flexible, be clear that your expectations are informed and open to discussion.

Don’t sound overly focused on money

Saying something like “I won’t accept less than X” without context can signal that compensation is your only priority. While it’s important to know your bottom line, balance it with interest in the role itself, the company culture, and growth opportunities. Employers want to hire people who are motivated by more than just a paycheck.

Frequently Asked Questions

What should I put for salary expectations on a job application?

If a field is required, enter a reasonable salary range based on your research. You can also write "Negotiable" if allowed. Avoid entering “0” or leaving it blank since it may make your application appear incomplete and disqualify you.

How do I handle salary expectations if I'm changing careers?

Base your expectations on entry-level pay for your new field, not your previous salary. Highlight transferable skills and be open to discussing how your past experience brings value to the new role.

Should I include salary expectations when applying for an H-1B visa role?

H-1B roles are subject to specific wage requirements set by the U.S. Department of Labor. Employers must meet these minimum salary thresholds, so you should research the H-1B wage level applicable to the job and align your expectations accordingly.

Can I update salary expectations after applying?

Yes, especially if your research changes or you learn more about the role during interviews. If you need to broach the topic of salary again, revisit the conversation during the negotiation portion of the process or clarify yourself in a follow-up email.

How are salary requirements different from desired compensation?

"Salary requirements" often suggest a minimum you're willing to accept, while "desired compensation" may imply your ideal target including bonuses and benefits. Be clear about what your range includes and factor in any additional perks.

Is it okay to ask about salary before an interview?

It’s best to wait unless the employer brings it up or lists a vague salary range in the posting. If you need to ask, frame it professionally: “Can you share the general salary range for this role so I can confirm it aligns with my expectations?”

How do benefits affect salary expectations?

Benefits like healthcare, retirement contributions, and paid time off can significantly impact total compensation. If the base salary is slightly lower but the benefits are strong, your overall package may still meet your needs.

Key Takeaways

- Only include salary expectations if requested. Unless the employer specifically asks for this information, it's best to leave it out of your resume or cover letter to maintain flexibility during negotiations.

- You can include salary info in three places: on your resume (near the end), in your cover letter (typically the closing paragraph), or in a job application form with a dedicated field.

- Always do your research before sharing numbers. Use salary tools and industry benchmarks to develop a realistic, location-specific range that reflects your experience and qualifications.

- Use a salary range, not a single figure. Offering a range shows you’re informed but open to negotiation. If you're flexible, make that clear to the employer.

- Keep your language concise and professional. Whether on a resume or in a cover letter, one brief sentence is enough. Don’t let compensation overshadow your qualifications.

- Be prepared to discuss salary during interviews. When asked, respond confidently with a researched range, but be open to further conversation. If it feels too early, it’s okay to ask for more details before answering.

- Don’t give a number without research, don’t be vague (“whatever you think is fair”), and don’t focus too heavily on money at the expense of showing enthusiasm for the role.

- Tailor your expectations to each role. Company size, location, benefits, and advancement opportunities can all affect compensation, so adjust your range accordingly.