61% of Workers Fear Retirement More than Death, LiveCareer Survey Finds

For many workers today, the idea of retirement stirs up more fear than death. As they look ahead to life beyond the 9-to-5, concerns about financial security loom large, turning retirement into a nerve-wracking prospect and a daunting challenge.

According to a recent survey by LiveCareer, a startling 61% of workers fear retirement more than death itself. The survey uncovers deep-seated anxieties about financial preparedness and the challenges of stepping away from the workforce. In this report, we’ll explore the reasons behind these fears and what they mean for the future of retirement.

While virtually all participants state their goal is retirement — less than .5% say they don’t plan to retire — executing that plan might be tricky for many people surveyed. The majority of participants (82%) say they have considered delaying their retirement for financial reasons, and 92% worry that they will have to work longer than planned.

Let’s dive into the data to learn more about people’s fears surrounding retirement finances.

Retirement Elicits Fear in Workers

The survey asked a series of questions that explored workers’ fears surrounding retirement. The results show that 61% of workers fear retirement more than they fear death, and for 64% of participants, the thought of retiring is scarier than the idea of getting a divorce.

Other worries uncovered by the survey include:

- 54% said that retiring frightens them more than getting fired

- 53% said that retiring scares them more than falling into poor health

- 39% said that they fear retiring will make them a financial burden to loved ones

- 39% said that they worry they won’t have enough saved for medical emergencies or unexpected costs in retirement

Retirement Savings: A Gap Between Expectations and Reality

The study revealed a significant gap between workers’ expectations regarding retirement and their current financial realities. Here is what the data showed:

Retirement age plans

Of the individuals surveyed, 80% of workers stated they plan to retire in their 60s, with 46% aiming to retire in their early 60s (between ages 60 and 65) and 34% planning to retire between the ages of 66 and 70.

Additionally, 10% of people hope to retire before the age of 60 and 9% of respondents plan to retire between the ages of 71 and 75.

Projected financial needs

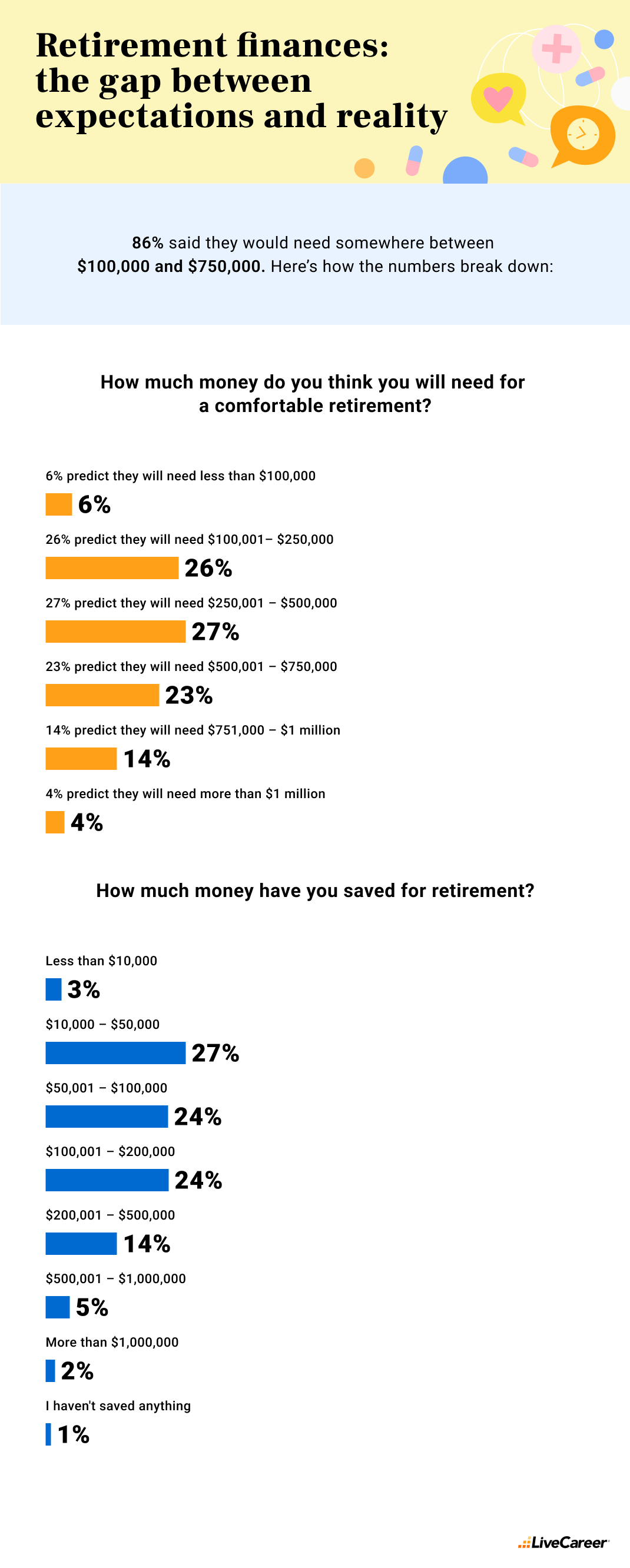

When asked how much money respondents would need for a comfortable retirement, there was a wide range of responses. However, 86% said they would need between $100,000 and $750,000.

Here’s how the numbers break down:

- 6% predict they will need less than $100,000

- 26% predict they will need $100,001 – $250,000

- 27% predict they will need $250,001 – $500,000

- 23% predict they will need $500,001 – $750,000

- 14% predict they will need $751,000 – $1 million

- 4% predict they will need more than $1 million

Current level of savings

When it comes to savings, however, what people have saved didn’t align with their predicted needs. When asked about the progress they have made toward retirement savings, here’s how the numbers break down:

- 3% Less than $10,000

- 27% $10,000 – $50,000

- 24% $50,001 – $100,000

- 24% $100,001 – $200,000

- 14% $200,001 – $500,000

- 5% $500,001 – $1,000,000

- 2% More than $1,000,000

- 1% I haven’t saved anything

Problems with meeting retirement savings goals

When asked which issues they face in achieving their retirement savings goals, 82% say inflation has significantly impacted their ability to contribute to retirement savings. The COVID-19 pandemic also made an impact, with 87% reporting that it affected their ability to save for retirement.

Income in retirement

Only 42% of those surveyed say they feel highly confident they are on track to save what they need in retirement.

For those not as confident in their ability to retire comfortably, the survey found:

- 43% of participants plan on retiring from full-time work but continuing part-time in their field for as long as possible

- 29% plan on retiring from their current profession and taking a part-time job in a different field

Retirement Brings Up Financial Fears

When asked to name their most pressing retirement worries, 82% of workers said they have considered delaying their retirement for financial reasons, and 92% are at least somewhat worried that they will have to work longer than they anticipated due to financial constraints.

Other top financial anxieties include:

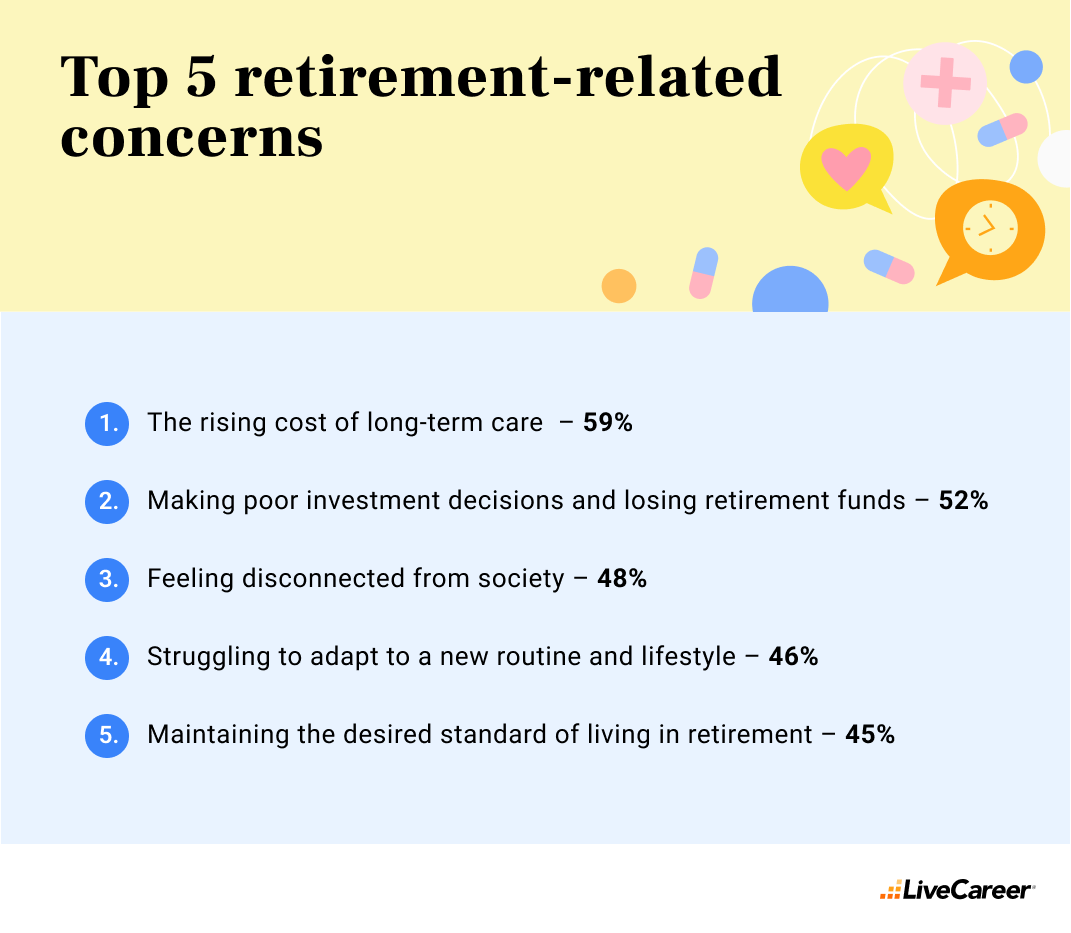

- 59% cited the rising cost of long-term care as their top concern

- 52% cited making poor investment decisions and losing retirement funds

- 48% worry they will feel disconnected from society in retirement

- 46% worry they will struggle to adapt to a new routine or lifestyle

- 45% were nervous about maintaining their desired standard of living in retirement

- 44% fear potential shifts in government benefits

- 41% report feeling insecure about the stability of their investments

- 41% say medical expenses are a concern

- 30% fear inflation

Retirement promises new beginnings but also the uncertainty of uncharted territory. The survey revealed that financial stability is a primary concern, but worries extend to health, social connections, and overall well-being. Many struggle with losing the identity and purpose work provides, or adjusting emotionally to a new routine. This underscores the need for comprehensive retirement planning that covers both financial and personal aspects.

Debt Concerns Hampering Retirement Plans

Debt concerns are another factor that may be adding to workers’ fears about retirement. The survey showed that 82% have debts that could impact their retirement. Of those in debt, 35% have debts exceeding $100,000.

Here are the types of debt people are contending with:

- 44% have credit card debt

- 41% have car loans

- 39% have medical debt

These financial realities paint a stark picture of the challenges ahead, highlighting the importance of early retirement planning. While retirement is filled with many unknowns, careful planning will help navigate these challenges and ensure a secure future. Taking proactive steps today can ease the uncertainties of tomorrow.

Methodology

The findings presented were obtained by surveying 1,031 American respondents on June 4 – 5, 2024. Participants were queried about various aspects of retirement. They answered different types of questions, including yes/no, open-ended, scale-based questions where respondents indicated their level of agreement with statements, and multiple-choice where they could select from a list of provided options.

About LiveCareer

LiveCareer’s online Resume Builder is designed to empower its users to get better jobs and improve their job search. A one-stop shop among AI resume builder tools, LiveCareer features cutting-edge resume templates, a powerful cover letter builder, and extensive free career resources to support job candidates in reaching their professional goals. Trusted by over 10 million users around the world, LiveCareer has been publishing expert advice from Certified Professional Resume Writers since 2005. LiveCareer’s career tips have been featured in renowned media outlets, including Bloomberg, Forbes, and Newsweek. Stay connected with LiveCareer’s latest updates to improve your job search on Facebook, Instagram, LinkedIn, and X.